Share This Article

Let me ask you something. How do you track your daily expenses? Through piles of receipts!

Well, let’s be honest here. We never track our expenses by counting receipts.

However, there is always this urge to track our monthly expenses to see where we are spending our money the most.

Managing our personal finances is important. After all, savings are vital for survival. And the pandemic has proven this financial management and saving concept.

So, coming back to my question, how do you guys keep track of your daily expenses? For me, my very first budgeting tool was MS Excel (Which sounds foolish, but yes!). During my freelancing period, I used to put numbers on the sheet daily to understand my performance, and by this, I used to save money for my goals. However, soon I realized how daunting all this is.

Technology indeed brings changes for convenience. Today, there are various mobile applications in the app store like budgeting apps or expenses tracking apps, and by using these you can certainly rule the world with your smartphones.

So, what do you know about budgeting apps? Have you tried any budget manager app?

Being in a web and software development company, we have come across many audiences asking how to build a budgeting app? How much time will it take to build a budget manager app? And many more.

So, we have decided to discuss budgeting apps in today’s blog, and we are planning to give you a step-by-step guide to building a budgeting app.

Let’s start!

What Do You Understand By Budgeting App?

I am sure that you know what the term means, but still, for the sake of the blog, let’s go over the definition of a budgeting app.

A budgeting or budget manager app is a mobile application that provides assistance to take care of personal finances like budgeting, saving, investing, and other fun stuff that we do with our money.

A budget manager app has been in high demand. And with the GenZ changing over adulthood and being the first generation who use technology in all aspects of their life, thus the need for financial mobile apps is on the rise.

Today, this market is growing so much that they have now started to target specific groups, such as people dealing with economic instability, those tracking their savings and investments, and sections like families or friends, sharing costs, and much more.

The budgeting apps sync the credit card, bank, and investment accounts all in one place to keep track of all the daily expenses and see them in the forms of graphs and charts. The journey of budget manager apps started in the year 1983 with the launch of Intuit company and its flagship product, “Quicken,” designed for MS-DOS and Apple Ⅱ.

But soon, these services started to expand their features, like adding payment reminders and budget planning.

Generally, there are two types of budget manager apps:

- Manual, here you have to enter all the data personally and mention the figures and category of each purchase.

- Linked, here the application draws all the records about the expenses automatically.

Why do people love downloading budgeting apps on their mobile phones:

- They ease the financial management process.

- It’s a good way to control and visualize exactly how much money you are spending.

- They help with saving money and making plans for the future.

- They prepare us for financial emergencies.

- They make tax tasks less complicated.

Why is the Budgeting Apps Market So Bright in 2022 and Beyond: Market Overview

2022 started with the frequent growth of digital banking and digital payment and hence increased the acceptance of budget manager platforms.

According to the market report, over 25 percent of the US population is under nineteen. So various budgeting apps are targeting the younger audience. The essence here is that youngsters and children will generate trust in a brand and transition into lifetime users as they transform into adulthood.

Based on the CB Insights report, Gen Z and Millennials will inherit a great amount of personal wealth. Still, they are illiterate when it comes to their personal finances. The Credit Karma report says that 56% of millennials think that their financial goals are out of their reach. And 85 percent of the generation says that they feel burned out and that they fail to deal with personal finances.

The project size of the personal finance apps market in the US is estimated to be $343 billion. And over 53 percent of users use their mobile banking applications.

Therefore, budgeting apps should grab this opportunity to help the younger generation.

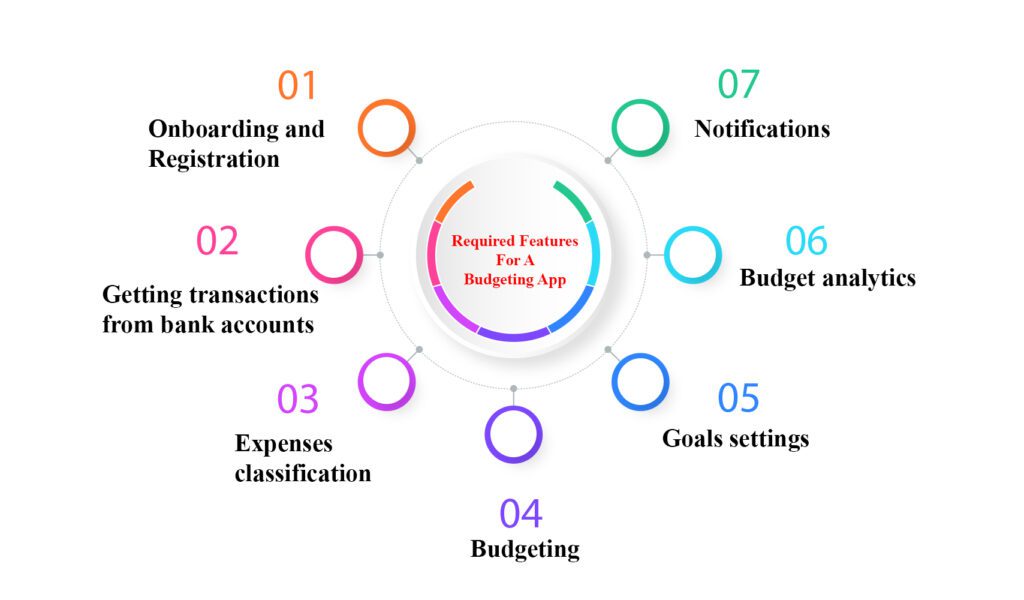

Required Features For A Budgeting App

So, now that we have seen a lot of budget manager apps, their applications, and some successful apps in the same category, we can effortlessly discover the features that users will accept from such kinds of applications.

Without wasting any more time, let’s go through these features:

Onboarding and Registration

The budgeting apps need very little information for the registration of new users. This information is- email & password and basic demographic information.

However, to simplify the registration process, you can also include social media login options and can skip the part about demographic details.

Getting transactions from bank accounts

After entering my expenses manually on MS Excel, I don’t want to enter my expenses manually anymore. What about you guys?

If you also cannot force yourself to write expenses manually, then this feature will be very helpful for you.

With the transaction fetching feature, our budgeting app will link the user’s bank accounts using private and safe APIs and will fetch all the transaction data. Thus, making our tasks easy.

Expenses classification

After getting the user’s transactions into the app, we will have to tag them carefully. With this feature, the app can tell where and what exactly we are spending our money on. In fact, I find this a very killer feature.

Budgeting

There is a quote from a Financial guru, Dave Ramsey. He quotes that-

“You’ve got to tell your money what to do or it will leave.”

So, we all should offer a budgeting option for our users to plan their expenses.

Goals settings

The whole purpose of the budgeting app is to make customers realize their financial goals. So obviously, there should be an option to enter these goals in the application.

Budget analytics

With this feature comes AI and ML into the limelight. Depending on the end-users spending trend, this respective technology will eventually decide about the expected budget in the near future.

Notifications

Well, it is important to keep the users updated about what is happening with their finances. So we should notify them about all new transactions, products, and achievements.

Additional Features

With the additional features, you should get creative while designing a budgeting application so that your solution stands out.

For example, you can add options like:

- Investing

- Scheduled payments

- Social competitors

- Gamification

- Voice interface

Selecting the Tech Stack

The majority of the startups choose a cross-platform mobile development substructure to speed up the time in the marketplace. At Extern Labs, we prefer React Native and Flutter.

As these tools are like a treat for our partner’s app development budget.

Moreover, one should plan to add some advanced options like ML image or text recognition features. For this, you will need Swift and Kotlin’s expertise.

Steps To Make A Budget Manager App.

We created a finance app so that users can install it from the app stores. So let’s look at the developmental life cycle of an application.

So if you are curious about how a custom-developed mobile app is visible in an app store then this segment till the end, to see what steps we take for developing a mobile application.

STEP 1. Discover and design a prototype

The very first step is to design and confirm the prototype. Today’s generation easily gets bored with mobile applications that don’t excite them at all. Thus, this step becomes important. I can stress more and more how verification is a vital part of prototype testing. Because we should launch something that is top-notch and catches users’ attention.

STEP 2. Create an MVP

In the next step, we enter the coding part of the app development process. App developers put all the application features together. Back-end developers build the server-side for linking user data and offering web access to the application.

STEP 3. Apply security

Even though the security feature is implemented during the development stage, I still think that this step should be singled out as a distinct step. There is no if that security is important in budget manager apps.

STEP 4. App Testing

Before launching the application, it is paramount to run the app through a proper QA cycle. Although, testing is the least exciting part of developing a finance app. It is all the effort of a QA Analyst to make a flawless mobile application for our users.

STEP 5. Launch the app on the app store

If you have never seen it, the app store submission process sounds very fun. However, in reality, several app owners have to clear a few things before the application gets accepted by Apple and Google.

However, the work doesn’t stop only at launch. After the application launch, comes app maintenance. In the software development process, we term it DevOps.

Related: Application development cost.

Why Choose Extern Labs?

We are a web and software development company. We have experience in developing customized applications in almost all sectors including the financial sector.

And FYI, the mobile development team offers the benefit of an in-house team while providing one more benefit i.e, finding talent from all over the world.

Thus, we advise you to choose a professional app development company because all the team members work under one roof. So if you want to create a budgeting app like Payroll and Mint, then drop us a line.